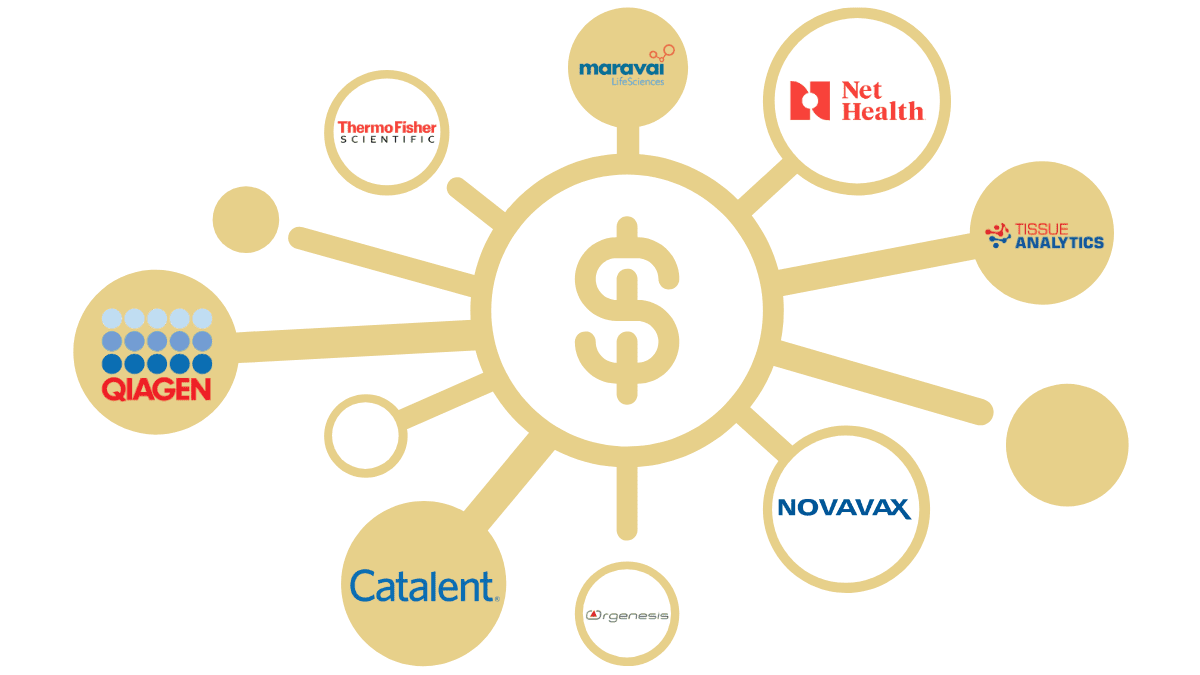

BioHealth Capital Region M&A Roundup First Half of 2020

It has been a tumultuous 2020 for venture capital and mergers and acquisitions due to the market uncertainty sparked by the onset of the coronavirus pandemic. Companies seeking acquisitions and venture capital firms alike continue to find their footing, as do the life science companies progressing toward important milestones during a global public health crisis.

There are, however, deals still getting done as evidenced by Baltimore’s Tissue Analytics acquisition by Net Health, which was announced in mid-May, as well as Novavax’s purchase of a manufacturing facility in early June.

Clearly, COVID-19 has delayed some potential M&A deals and has caused some interesting challenges for VC firms as well. But there are positive signs right here in the BioHealth Capital Region with counties and cities beginning to move into more open phases of COVID-19 recovery, as well as the recent remarkable drop in the unemployment rate to around 13%, as of June 5th.

It will be interesting to see the impact on the M&A front as the U.S. opens up and if the economy begins to recover. Will M&A activity accelerate in the second half of 2020? Or will the M&A and VC funding floodgates open only when a COVID-19 vaccine is approved by the FDA?

Here’s a brief roundup of Q1/Q2 M&A deals in the news related to the BHCR.

Qiagen NV Acquired by Thermo Fisher Scientific, Inc. for $10B

Qiagen NV, which has locations in Germantown and Frederick, Maryland, was purchased for $10B by life science giant Thermo Fisher in early March 2020. Qiagen has its headquarters in the Netherlands and is one of the world’s leading molecular testing companies. The deal is the second-largest for Thermo Fisher, whose purchase of Life Science Technologies Corp. totaled $13.6B, according to Bloomberg News.

Orgenesis Inc. Acquired by Catalent for $315M in Cash

Germantown, Maryland’s Orgenesis, Inc., a leading developer, manufacturer, and service provider of advanced cell therapies, was acquired by Catalent in early February 2020. The deal included Orgenesis’ subsidiary Masthercell Global Inc., which is a global contract development and manufacturing organization (CDMO). Catalent, Inc. is the leading global provider of advanced delivery technologies, development, and manufacturing solutions for drugs, biologics, gene therapies, and consumer health products. The company also acquired Paragon Bioservices for $1.2B in 2019.

Novavax Acquires Manufacturing Plant for $167M

Gaithersburg, Maryland’s Novavax, which has been a central player in the ongoing effort to develop a COVID-19 vaccine, announced in early June that it had acquired a manufacturing facility for $167M from the Czech Republic company Praha Vaccines a.s., which part of the India’s Cyrus Poonawalla Group.

The plant is expected to produce up to 1B antigen doses annually for the company’s COVID-19 vaccine candidate starting in 2021. The deal also includes adding 150 plant vaccine manufacturing staff from Praha Vaccines to the Novavax team.

Baltimore’s Tissue Analytics Acquired by Net Health (Terms Undisclosed)

Tissue Analytics, a developer of automated, mobile wound and skin imaging and predictive analytics solutions, was acquired by Net Health for an undisclosed amount, according to a May 2020 Net Health announcement. Tissue Analytics traces its roots back to Johns Hopkins University, where its founders first met while in the school’s Center for Bioengineering Innovation and Design (CBID) program in 2013.

The company’s philosophy is to “…the use of artificial intelligence in medicine. Our clinicians work towards making the physician-machine partnership a reality. We use machine learning to do two things: Extract value images and automate tedious documentation.” Tissue Analytics will augment Net Health’s already strong position within the wound care market.

All of Tissue Analytics 30 employees have joined Net Health as part of the deal, and, according to Net Health’s press release, “Tissue Analytics applications will be integrated with Net Health’s industry leading WoundExpert® EHR solution to add key capabilities for use within hospital outpatient settings. Clinicians will be able to capture and seamlessly upload wound images and other documentation, including automated measurements, to the WoundExpert platform.”

Rockville’s MachV Solutions Purchased by Maravai LifeSciences (Terms Undisclosed)

MachV Solutions, a former BHI portfolio company, was acquired by San Diego, California’s Maravai LifeSciences, a global provider of life science reagents and services to researchers and biotech partners. MachV Solutions. MachV will be integrated into another company recently acquired by Maravai, Cygnus Technologies, LLC. David Cetlin, the Founder and CEO of MachV, has joined Cygnus Technologies as Senior Director, R&D.

MachV Solutions, according to Maravai’s acquisition announcement, “…has developed non-infectious mock virus particles that mimic the properties of live infectious viruses used as spiking agents during viral clearance testing. MockV products contain these surrogate particles along with reagents to perform quantitative clearance analysis. Mock virus particles look and behave like viruses, but are non-infectious, allowing drug manufacturers to work with them inexpensively and with minimal risk while developing final manufacturing processes that can easily demonstrate viral clearance to regulators.”

- About the Author

- Latest Posts

Steve brings nearly twenty years of experience in marketing and content creation to the WorkForce Genetics team. He loves writing engaging content and working with partners, companies, and individuals to share their unique stories and showcase their work. Steve holds a BA in English from Providence College and an MA in American Literature from Montclair State University. He lives in Frederick, Maryland with his wife, two sons, and the family dog.