Novavax Faces Uncertain Financial Future

By Alex Keown

March 1, 2023

Financial uncertainties are casting shadows on Novavax’s ability to continue operations due to changing markets related to the sale of vaccines for COVID-19.

In its Feb. 28 2022 year-end earnings call, the Gaithersburg-based company announced plans to cut spending to preserve its cash runway while preparing for the fall vaccination season – a season that could be a make-or-break situation. New Chief Executive Officer John Jacobs, who took over the company reins at the beginning of the year, said there are concerns related to its revenue streams due to uncertainties of U.S. government funding, as well as ongoing arbitration with Gavi, the global vaccine alliance.

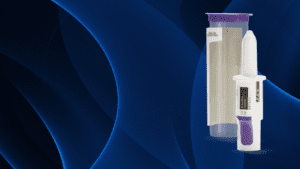

During the call, Jacobs said the company is anxiously waiting information from the FDA regarding strain selection for fall vaccines. That strain selection will determine what vaccines will need to be produced to provide the best protections for the public, Jacobs added. In order for Novavax’s COVID-19 vaccine to remain competitive in the shifting market, the company will need to remain proactive in developing a vaccine against the appropriate strains of the SARS-CoV-2 virus, due in part to the longer production window for its protein-based Nuvaxovid vaccine compared to the top mRNA-based vaccines. Novavax’s COVID-19 vaccine induces broad functional immune responses, including for contemporary variants

The Nuvaxovid vaccine was authorized for use by the FDA in July 2022 – more than a year after Pfizer/BioNTech and Moderna gained firm footholds in the U.S. market with their mRNA-based vaccines. The company’s road to approval was long due to production and manufacturing delays. The company has since expanded the Nuvaxovid label as a booster, which the company believes will enable broader uptake in the long-term commercial market.

When the U.S. government ended the public health emergency in May 2022, that signaled a change in the market, Jacobs noted. While there are still significant opportunities for Novavax in the U.S. and abroad, the company will face market challenges due to a shift from a pandemic phase to an endemic COVID-19 landscape.

One significant hurdle the company is facing is the government’s decision to terminate its existing agreement with Novavax at the end of 2023. That places more than $400 million in government funding at risk, Chief Financial Officer Jim Kelly said.

Given the uncertainty of the fall vaccination process, the company will not provide full year guidance at this time, Kelly noted.

The company’s ongoing arbitration with Gavi also creates an uncertain economic situation. In November 2022, Novavax announced it terminated its $700 million agreement with Gavi over that organization’s alleged failure to purchase contracted COVID-19 vaccines before the end of 2022. Gavi has countered those claims and is seeking financial retribution. Kelly said the arbitration outcome with Gavi is uncertain, which promoted the company to implement cost-savings strategies, which include a decision to place a moratorium on hiring for positions not considered critical to operations.

“Our goal is to strengthen the company in the near term in order to put ourselves in a position for future growth,” Jacobs said.

Other efforts to improve the company’s bottom line include curbing spending and rationalizing its existing portfolio. Jacobs said the company decided to suspend development of an RSV asset. The company could also cut some overseas resources, Jacobs said.

Beyond its COVID-19 vaccine, the company is assessing a combination COVID-19 and influenza vaccine in a mid-stage trial. Topline results are expected later this year.

Novavax closed out 2022 with $1.9 billion in revenue, a 73% growth over the previous year.