BioHealth Capital Region Startups Raised More Than $739M in 2019

These 15 Biohealth Startups had a Banner Year, Setting Themselves Up for Success in 2020

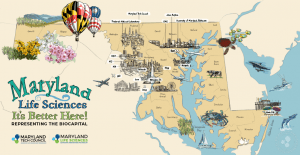

The startup ecosystem in the BioHealth Capital Region (BHCR) is as healthy as ever, as 2019 saw a host of new companies launch while still others secured important funding deals that could help shape their future.

As we move into a new year, BioBuzz is taking a look back at the life science investment year that was, which included a host of capital investment deals. BioBuzz worked with Informa Pharma Intelligence (Source: Strategic Transactions | Informa, 2019) to gather the data on the deals that happened in the BHCR this past year. For the purposes of this article, ‘startup companies’ are categorized by those companies who had been in business for five years or less.

2019 Startup Investment Deals

Venture funding challenges have been a widely discussed topic across the BHCR. Access to funding in the $500K to $5M range has been a particular challenge for the region, which has seen an overall uptick in venture capital funding and deal size over the past few years. While access to VC remains an ongoing challenge, the following startup companies secured important investment in 2019, including venture funding and IPOs of more than $739M in total investment raised.

- Neuraly and Theraly are two Johns Hopkins spin-out companies who were part of the $137.1mm Series B round raised in August by their parent company, Korean biotech D&D Pharmatech. Allocation of the funds between its three subsidiaries was not specified but we felt that this deal warranted a first mention on the list because it impacted two early-stage biotechs growing in the region. Proceeds will support the advancement of Neuraly’s lead candidate NLY01 (a GLP-1R agonist) into Phase II in Parkinson’s and Alzheimer’s diseases and move Theraly’s preclinical myofibroblast-targeting TLY012 into Phase I/II in chronic pancreatitis and liver fibrosis, including nonalcoholic steatohepatitis (NASH).

- Thrive Earlier Detection Corp., a cancer diagnostics start-up with offices in Baltimore, launched with $110M in Series A funding provided by Third Rock Ventures (lead), Section 32, Casdin Capital, Biomatics Capital, BlueCross BlueShield Venture Partners, Invus, Exact Sciences, Cowin Venture, Camden Partners, Gamma 3 LLC, and others. Proceeds from the raise will be used to advance CancerSEEK, a liquid biopsy test designed to detect multiple cancer types at earlier stages of disease, to market.

- Arcellx, Inc., a privately-held biopharmaceutical company, raised $85M in oversubscribed Series B financing from a variety of partners in October 2019. Investors included Aju IB and Quan Capital that co-led the round, followed by Mirae Asset Venture Investment, Mirae Asset Capital, LG Technology Ventures, JVC Investment Partners, and certain funds managed by Clough Capital Partners, L.P. Existing investors Novo Holdings, S.R. One Limited, NEA and Takeda Ventures also participated in the financing. Proceeds will be used to advance the Company’s ARC-T + sparX programs, including clinical development of a bivalent BCMA-targeted cell therapy in multiple myeloma, and a CD123-targeted therapy in acute myeloid leukemia.

- Viela Bio, the Gaithersburg, MD-based biotechnology company that was founded in February 2018, tops our list for the most total capital raised in 2019, however it wasn’t all through venture capital. Viela raised $75 million in Series B financing in June, 2019, bringing the total capital raised since the company’s launch to more than $300 million. to advance their lead product candidate, inebilizumab, for the treatment of neuromyelitis optica spectrum disorder. This was the last private investment for the fast-moving startup who went public on the NASDAQ market on October 3rd where they raised an additional $160M through their IPO. Viela Bio was one of two biotech companies that went public in Maryland this past year.

- Nextcure was the only other BioHealth related IPO this year which grossed $82.25M in their public offering in May 2019. After launching in 2015, the clinical-stage biotech out of Beltsville, MD has attracted substantial investment and attention for their cancer immunotherapies. Led by President and CEO Michael Richman, formerly of MedImmune and MacroGenics Inc. (NASDAQ: MGNX) before more recently founding Amplimmune that was acquired by AstraZeneca in 2013. Their IPO came just over six months after they closed a $92M Series B in 2018.

- Landos Biopharma, Inc., a Blacksburg, VA-based biopharmaceutical company focused on developing improved treatments for autoimmune diseases, raised a $60 million Series B to advance the company’s Phase 2 global clinical trials for BT-11 in ulcerative colitis and Crohn’s disease. Financing was led by RTW Investments and Perceptive Advisors (Perceptive Xontogeny Venture Fund and Perceptive Life Sciences Fund) and joined by new investors, including Osage University Partners and Paul Manning.

- Adaptive Phage Therapeutics, a clinical-stage biotechnology company in Gaithersburg founded to provide an effective therapeutic response to the global rise of multi-drug resistant (MDR) pathogenic bacteria, received $7M in funding, including contributions from Alexandria Venture Investments, in October 2019. Proceeds will be deployed to support multi-center phase 2 clinical studies for its PhageBank® therapy for antibiotic-resistant bacterial infections.

- LifeSprout, a regenerative medicine company founded in 2015 raised a $6.5M Seed round from several investors that included institutional investors Maryland Technology Development Corporation, Kairos Venture Partners, Triskelion Investments, Ginkgo Gofar, and AngelMD, as well as Medytox, Inc., a strategic investor. LifeSprout is using proceeds from the financing round to support clinical development and scale-up of the first products from its Regenerative Matrix technology platform.

- Veralox Therapeutics, a preclinical stage company located in Frederick and focused on accelerating the development of first-in-class therapeutics for unmet medical needs, raised $5.4M seed funding round in September 2019. The funding was led by the JDRF T1D Fund, Sanofi Ventures, and the VTC Innovation and VTC Seed Fund, with participation from the Maryland Momentum Fund, the University of Vermont Health Network and TEDCO.

- Embody, Inc., a Norfolk, Virginia based developer of an innovative collagen-based microfiber implant called Tapestry designed for use in Achilles’ and rotator cuff repairs, raised $3.6M in funding.

- Aperiomics, Inc., a biohealth data science company located in Sterling, Virginia, raised $1.8M in August 2019. Its Series A financing was led by VentureSouth, which was joined by Pipeline Angels, Propel(x) and various wealthy individuals.

- Sonavex, raised $1.8M in funding this November to complete a $3M round to help drive commercialization efforts. The company’s EchoSure technology is designed to detect blood clot formation in surgical patients, as well as pipeline development of perioperative ultrasound solutions.

- NeoProgen, a Baltimore-based company led by Medtech entrepreneur Bill Niland, raised $1.5M in seed funding from the Maryland Momentum Fund as it develops a cell therapy for patients following a heart attack.

- MiRecule, a Gaithersburg, Maryland-based early-stage biopharmaceutical company focused on developing microRNA-based therapies for drug-resistant cancers, raised $1.5M in funding in a deal struck while attending BioHealth Capital Region’s 2019 Investment Conference.

- Gemstone Biotherapeutics of Baltimore, a clinical-stage biotech company developing innovative, evidence-based products for scar-free skin regeneration, received a $250,000 investment from the University System of Maryland (USM) Maryland Momentum Fund.

Other Notable Investment Deals

Though no longer considered a startup, several other companies attracted significant investment this year to move their companies forward. These established companies raised more than $149M in capital investment in 2019.

The largest of such investments was with Graybug Vision who raised $80 in additional funding to advance its retina and glaucoma clinical programs. Graybug is now headquartered in CA but was founded and still maintains a research and development hub in Baltimore. Montgomery County, MD-based Sirnaomics raised an additional $22M in two C-rounds that totaled $47M overall, and RoosterBio, the Frederick stem cell manufacturing company, also raised $22M to expand operations and scale.

Other investments were raised by NexImmune who closed out a $10M Series B round with an additional $2.3M (according to SEC reports), as well as BioFactura who raised $6M in funding that helped them to land a large $67.4M government contract for its Smallpox biodefense therapeutic program. In the public markets, MaxCyte raised £10M in the placement of stock in February and Neuralstem raised $7.5M in a follow-on public offering in July.

2019 was certainly an exciting year for startups in the BHCR, as well as for established companies that combined raised nearly $900M in funding.

What will 2020 have in store for these companies, and what new companies will emerge?

BioBuzz will be keeping tabs on these growing companies and new startups that are sure to emerge from the vibrant ecosystem of serial entrepreneurs, government research organizations, research universities, and support organizations that continue to push the BHCR to new heights as a world-leading biotech hub.

- About the Author

- Latest Posts

Over the past 11 years, Chris has grown BioBuzz into a respected brand that is recognized for its community building, networking events and news stories about the local biotech industry. In addition, he runs a Recruiting and Marketing Agency that helps companies attract top talent through a blended model that combines employer branding and marketing services together with a high powered recruiting solution.