iECURE Snags $65 Million to Support Knock-In Gene Editing Asset for OTC Deficiency

iECURE CEO Joe Truitt (Source: iECURE)

A $65 million infusion of cash will enable gene editing company iECURE to take its lead asset for Ornithine Transcarbamylase (OTC) deficiency into the clinic within the next 18 months,

Philadelphia-based iECURE, which is collaborating with Jim Wilson’s Gene Therapy Program (GTP) at University of Pennsylvania, secured $65 million in Series A-1 financing to support its knock-in gene editing therapeutics for liver disorders. Combined with $50 million raised in a previous Series A round, iECURE is well-financed to take its lead asset, GTP-506 into the clinic.

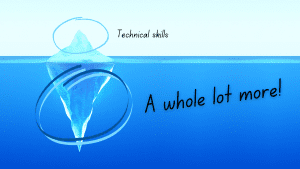

Chief Executive Officer Joe Truitt explained that iECURE’s approach to gene editing is different than those taken by other companies. Instead of knocking out or modifying a defective gene, iECURE is using in vivo gene insertion to insert full, healthy donor genes into the liver of the patient. Truitt said iECURE wants to use its approach to address diseases that have to do where there is a loss of function or no function in a gene, “where the genes aren’t doing what they’re supposed to be doing.”

iECURE’s lead program is aimed at OTC deficiency, the most common urea cycle disorder. OTC is caused by a genetic defect in a liver enzyme responsible for detoxification of ammonia. The buildup of ammonia can lead to devastating consequences, including irreversible neurological damage, coma and death. OTC is most commonly seen in newborn children and currently the only treatment for early onset severe OTC deficiency is a liver transplant.

GTP-506 is designed to insert a donor OTC gene into the liver of an infant in order to deliver the necessary genetic correction so the child can live a full and healthy life, Truitt said. The gene therapy relies on the use of the ARCUS nuclease to cut the genome at the well-characterized PCSK9 site. Then, a healthy gene delivered via an adeno-associated virus will be delivered to the target.

The company has accumulated significant animal data that shows the gene editing program can successfully deliver the donor OTC gene. The company also has data showing a durable effect in the treated primates, Truitt added.

Now, the company aims to replicate those same results in human patients, Truitt said.

“Based on the data we have in the non-human primates, we have a legitimate chance of translating those results into humans,” Truitt said.

Ahead of entering the clinic, iECURE has been working closely with gene therapy giant Jim Wilson and the Gene Therapy Program (GTP) at University of Pennsylvania to develop its own platform. Truitt touted Wilson and his team for laying the groundwork in the gene editing field, groundwork that has resulted so far in the approval of multiple gene therapy treatments for rare diseases, including several this year alone.

The company has established manufacturing partnerships with both Catalent in Maryland and the Center for Breakthrough Medicines, which is where Wilson’s program is now located.

Truitt said he anticipates the filing an Investigational New Drug application with the FDA in the third quarter of 2023. If it is accepted, Truitt believes iECURE can dose the first patients by the end of the year, with first readouts expected in early 2024. The FDA has granted both Orphan Drug Designation and Rare Pediatric Designation to GTP-506 for the treatment of OTC deficiency.

Beyond GTP-506, iECURE also has two other assets in development. One is for a urea cycle disorder known as citrullinemia type 1, a genetic condition caused by the lack of an enzyme involved in excreting excess nitrogen from the body, and the other is in phenylketonuria (PKU), a metabolic disease caused by a genetic defect that leaves patients unable to break down a particular amino acid, one of the building blocks of proteins. Left untreated, the amino acid, phenylalanine, builds up in the body and causes severe developmental problems and long-term health issues. Truitt anticipated the identification of these clinical candidates next year.

In addition to the advancement of iECURE’s lead therapy and development of the company’s other assets, the $65 million in financing will also enable the company to double its current headcount of 12 employees. Truitt said iECURE will need to onboard multiple employees for various roles as they move closer to the clinic. The Series A-1 was co-led by Novo Holdings A/S and LYFE Capital. There was also significant participation from existing investors Versant Ventures and OrbiMed Advisors, both of whom led the company’s $50 million Series A round. Having such renowned investors who conducted their due diligence ahead of contributing their resources provides validation for iECURE’s platform, Truitt said.