4 Key Insights for Startups and Entrepreneurs Looking to Grow a Life Science Business

BioHealth Capital Region Key Opinion Leaders and Connectors Share Thoughts on Growing the Region’s Innovation Ecosystem

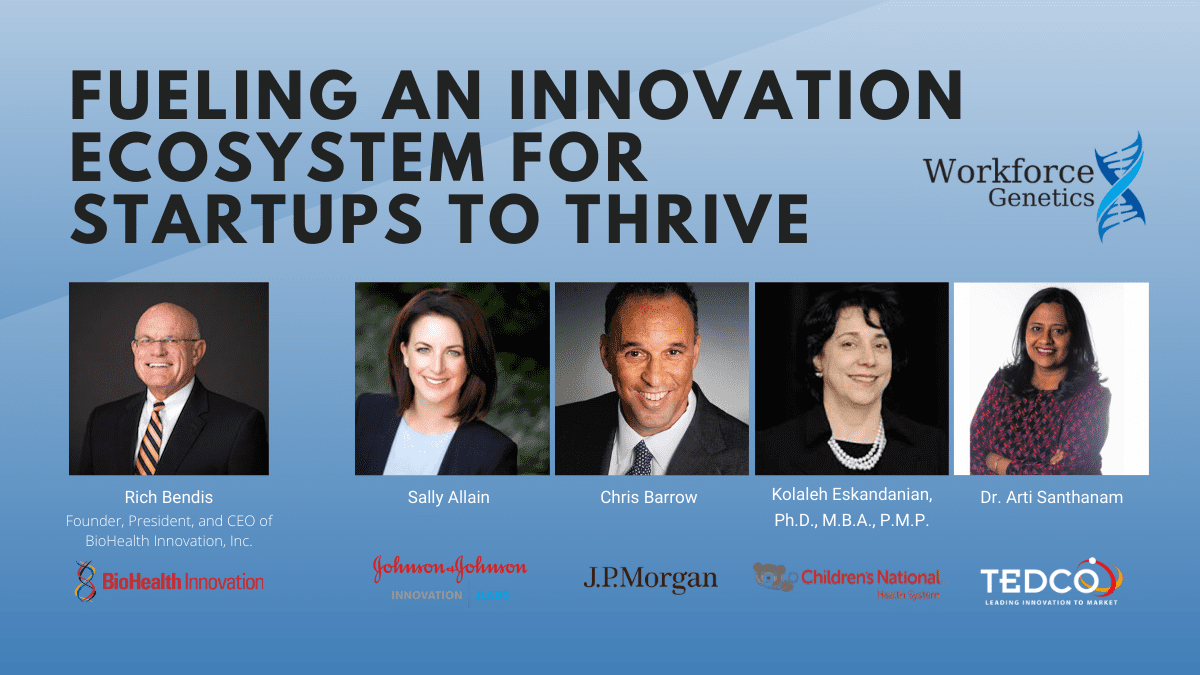

Driven entrepreneurs and savvy startup leaders participated in the recent “Fueling an Innovation Ecosystem for Startups to Thrive” webinar that featured prominent connectors and innovators from the BioHealth Capital Region (BHCR). The virtual event was sponsored by WorkForce Genetics and covered a wide range of topics including the pandemic, critical regional resources for startups, advice for approaching investors and a list of the biggest mistakes made by entrepreneurs when seeking funding.

Rich Bendis, CEO and President of BioHealth Innovation (BHI) moderated the event. Panelists included Sally Allain, Head of JLABS @ Washington DC; Chris Barrow, Executive Director, Life Sciences Banking at JP Morgan; Kolaleh Eskandanian, Vice President and Chief Innovation Officer at Children’s National Hospital; and Dr. Arti Santhanam, Executive Director at the Maryland Innovation Initiative (MII) at TEDCO.

The hour long webinar included a vigorous discussion among the panelists and also included interactive components including Q&A, chat, and live audience polling.

Here are some of the key takeaways from the Innovation Ecosystem for Startups conversation. You can watch the webinar in its entirety below.

COVID-19 Has Been Disruptive, But the Region and Life Science Market Remain Strong

Moderator Rich Bendis kicked off the webinar by providing some time for each panelist to introduce themselves to the audience and then the conversation quickly pivoted to how the pandemic had impacted their respective organizations.

Allain stated that the pandemic was a “big shift for all of us” and that JLABS had to alter and optimize some of its strategic plans for its portfolio companies. She shared that COVID-19 had not impacted the JLABS @ Washington DC opening, which was still on track, and that globally JLABS portfolio companies had new opportunities emerging as they pivot to COVID-19-related projects. Allain also emphasized Johnson & Johnson Innovation and JLABS @ Washington DC’s partnership with the Biomedical Advanced Research and Development Authority (BARDA), a component of the Office of the Assistant Secretary for Preparedness and Response in the U.S. Department of Health and Human Services, as a key public-private partnership in the fight against the pandemic.

Barrow of JP Morgan said that business has remained strong during the pandemic. He stated, “Initially the IPO market took a little bit of a dip after the shutdown but it’s been on fire ever since. In the first half of this year, there’s been $11B in the IPO market compared to $17B all of last year and venture capital (VC) firms have capital they need to deploy. It’s been a robust environment.”

Eskandanian shared that Children’s National was one of the first sites in the region to offer drive-through COVID-19 testing for its patients and employees. She also stated that non-COVID-19 clinical trials were delayed because Children’s National had pivoted all lab activity to handle pandemic related activities. She stated that “We are slowly picking back up and we are in Phase II of reopening and the labs are operating at about 25% capacity currently. Clinical trials have picked up as well.” But there have been some silver linings, including having time to advance grant applications as well as expanding the hospital’s telemedicine and digital health operations.

Santhanam echoed Eskandanian’s optimistic take, stating that the pandemic was “both a challenge and an opportunity…A lot of projects that used it as an opportunity were looking at quickly pivoting from medical device manufacturing to manufacturing respiratory valves, shields, PPE, and diagnostics for COVID-related diseases.” She added that regional universities have had challenges keeping research going because the labs have been closed and they will have a “hard path back.” She stated that “TEDCO is helping the universities as much as we can; we’re giving them extra funding and extensions and we are helping to bolster their workforce as well.”

Resources Abound for BHCR Startups

JP Morgan, JLABS @ Washington DC, TEDCO, Children’s National all have exciting programs to offer to entrepreneurs and startups looking to grow their businesses. Bendis and the BHI team also offer a diverse array of support programs for entrepreneurs and startups, including Small Business Innovation Research (SBIR) assistance, mentors, residence programs, and more.

Santhanam shared that TEDCO is funded by the state of Maryland and has multiple programs including MII, the Maryland Stem Cell Fund, the Builder Fund, and more. While the vast majority of TEDCO’s funding is directed to Maryland-based companies, opportunities for out-of-state organizations are available in certain cases. If interested you can take an assessment here to determine your eligibility for TEDCO programs.

Eskandanian offered that the National Capital Consortium for Pediatric Device Innovation (NCC-PDI), which is a partner of Children’s National, is one of only five Centers of Excellence for pediatric innovation in the world and is able to support select pediatric device startups around the globe. “This consortium is very open to help startup companies no matter where they are. So we source and scout the best pediatric device companies from all over the world,” stated Eskandanian. NCC-PDI runs its Pediatric Device Pitch Competition annually; ten finalists are selected to compete for approximately $250K in grant awards and up to $50K per company. NCC-PDI started the pitch competition to advocate for increased pediatric medical device innovation and to support emerging companies in their effort to commercialize devices for the younger patient population.

JP Morgan does not directly invest in startups, stated Barrow, but the company plays a key role in the region making connections between promising startups and its network of investors. He says it’s more like JP Morgan can “connect the dots” and “develop relationships early on” hoping to find the “…next Novavax, Emergent Biosolutions or Paragon Bioservices.”

Allain shared that companies that become part of the JLABS @ Washington DC innovation ecosystem get access to Johnson & Johnson mentors, a large network of partner companies and investors, and innovative programs around key scientific topics, intellectual property guidance, and pitch competitions. Allain stated that JLABS is a “…no strings attached incubator” that is looking to drive conversation in the region. Entrepreneurs or startups can simply apply online if interested. “We work internally to review those applications and we have a selection committee…We are not only interested at JLABS to bring you into the incubator but also at potentially partnering with Johnson & Johnson,” stated Allain.

Important Tips for Early Stage Companies Approaching Investors

In a nutshell, the panelists really emphasized the importance of doing one’s homework and being realistic and honest about one’s company and its potential.

Eskandanian and Santhanam both agreed that it is critical for young companies to do the research so they can truly understand their value within a given market.

Eskandanian shared that “Value assessment is very important early on for startup companies. When they have an idea they also have to think about who is going to pay for it. Before presenting to an investor it is very helpful to go through the process of understanding who the stakeholders interested in paying for your product are…we often use the Advamed value assessment tool to help companies in our accelerator start thinking about value. Understanding who the interested parties are to pay for your product is very important early on because it will help you clearly design your milestones and trials and make fewer mistakes along the way.”

Santhanam offered, “We have a pipeline of funding opportunities and you can graduate from one to the other. For early stage companies we are looking for a little more than proof-of-concept and more than an idea on the back of a napkin. We expect you to have some research dollars that have gone into a product…We look for a pitch deck, an understanding of the market and customer base…we know that you don’t have all the answers and we have resources that can provide your answers but we want you to have done some of that homework. And if we find you have a gap in resources, TEDCO, JLABS and BHI can help you fill those gaps.

JP Morgan’s Barrow emphasised a strong, concise pitch deck that outlines your company’s business model, timeline, what makes your product, technology or service different and how much it will cost is essential. He added, “You need to have an idea, a technology and you have to have it thought out properly….We often tell people to take a step back…It’s always better to make a mistake in front of us than a major investor. When in front of investors be honest. If you don’t know the answer, go back and get it. Don’t make anything up.”

Allain piggybacked on Barrow’s comments, adding that “We all look at things through a similar lens. In your pitch deck and details, what does your 12-24 month project plan look like against the competitive marketplace? Where are you against your competitors? If you do have funding, what does your runway look like against your project plan? We are very interested in your projected milestones and tell us why you want to partner.”

Biggest Mistakes Young Companies Make When Approaching Investors

It is well known around the BHCR that attracting and securing VC funding is one of the region’s biggest challenges. A great deal of improvement has been made in recent years, as VC investment numbers are steadily trending upwards, as events like the BioHealth Capital Region Forum and the BioHealth Capital Region Investment Conference and other similar events have helped shine the light on the great companies and assets of which the BHCR can boast.

But even with increasing VC activity in the region, securing a slice of the funding pie can be difficult if early stage companies make some commonly seen, big mistakes.

Allain kicked off this segment of the webinar by stressing that many young companies make the mistake of “…not doing the research of understanding where you are against your competitors in the marketplace. Feeling that you have a technology that is unique or further along while not even being aware of some other leading competitors in the market. She added that companies also need to look at alternative funding opportunities like SBIRs before jumping into the VC funding world.

Barrow stated that the biggest mistakes he sees startups make is “…your technology may be compelling but your company is only worth what investors are willing to invest. A lot of times the VC are betting not just on the horse but on the jockey. I caution people not to get overly optimistic about their valuation. Talk to as many people as possible and be realistic.”

Eskandanian shared that young companies shouldn’t “jump right into thinking VC funding is the only way. Startups should raise as much non-dilutive capital as long as they can so you can be more successful when you present to a VC.”

Santhanam added that “one of her pet peeves is that many companies don’t talk about their value proposition in terms of dollars. We help our companies develop a strong value proposition definition.” She added that it’s important for startups and early stage life science companies to identify the right customer and nail down their business model and plan. She suggested to get involved with local accelerators “…to help build your story.”

“Fueling an Innovation Ecosystem for Startups to Thrive” provided BHRC startup leaders and aspiring life science entrepreneurs useful tips and insights to keep them on the right track and thriving in the region’s powerful innovation ecosystem. Keeping the startup and early stage pipeline primed and producing more outstanding companies is an imperative if the BHCR is to reach its goal of “Top 3 in 2023.”

- About the Author

- Latest Posts

Steve brings nearly twenty years of experience in marketing and content creation to the WorkForce Genetics team. He loves writing engaging content and working with partners, companies, and individuals to share their unique stories and showcase their work. Steve holds a BA in English from Providence College and an MA in American Literature from Montclair State University. He lives in Frederick, Maryland with his wife, two sons, and the family dog.